About: Frazier Allen

Frazier Allen, WMS, CRPS, Financial Advisor with F&M Bank

50 Franklin Street | Clarksville, TN 37040 | 931-553-2048

Web Site: http://www.raymondjames.com/frazierallen

Email:

frazier.allen@raymondjames.com

Frazier Allen's Articles:

Frazier Allen: Domestic Stocks Hit All-Time Highs in August

Clarksville, TN – As summer comes to a close, the markets – as represented by the Dow Jones Industrial Average, Nasdaq Composite and the S&P 500 – reached new highs during August, putting all three major indices in uncharted territory.

Clarksville, TN – As summer comes to a close, the markets – as represented by the Dow Jones Industrial Average, Nasdaq Composite and the S&P 500 – reached new highs during August, putting all three major indices in uncharted territory.

Steady economic growth, rising consumer spending and improving corporate earnings coming in better than expected were all key factors in helping drive the market.

«Read the rest of this article»

Frazier Allen: The New Disruptors of Old Age

Nashville, TN – The traditional wisdom among Silicon Valley’s youthful technorati is to design for what you know—texting your friends in Europe for free (WhatsApp), renting out your bedroom to make extra cash (Airbnb), finding a romantic partner without leaving your house (Tinder). But a handful of entrepreneurs are now looking beyond the millennial market to reach a new demographic with their own needs — baby boomers.

Nashville, TN – The traditional wisdom among Silicon Valley’s youthful technorati is to design for what you know—texting your friends in Europe for free (WhatsApp), renting out your bedroom to make extra cash (Airbnb), finding a romantic partner without leaving your house (Tinder). But a handful of entrepreneurs are now looking beyond the millennial market to reach a new demographic with their own needs — baby boomers.

“You’ve got all these 20-something engineering types who are beginning to realize there are older adults who can make use of these products to promote health and well-being,” said Andrew Scharlach, Professor of Aging at the University of California, Berkeley. “What we are beginning to see is the marriage of product developers with the end users that they previously had not been aware of.”

From smart phones to smart homes, emerging technology is changing the way Americans approach aging — and Baby Boomers welcome the advances.

«Read the rest of this article»

Frazier Allen: Four Smart Withdrawal Strategies

Clarksville, TN – It’s official. You’re retired. As in, your days are yours alone. No early morning meetings. No deadlines. No paycheck.

Clarksville, TN – It’s official. You’re retired. As in, your days are yours alone. No early morning meetings. No deadlines. No paycheck.

Wait. What?

Without a job, you’ll no longer receive a salary. Something you’ve likely relied on every couple of weeks for the past 40 to 50 years.

It’s unlikely that Social Security alone will be enough to replace that flow of income and fully support your standard of living in retirement, which means it’s time to start drawing down the retirement income you’ve saved so diligently over the years.

«Read the rest of this article»

Frazier Allen: Social Security Myths and Misconceptions

Clarksville, TN – There’s no doubt about it. Filing for Social Security can be daunting.

Clarksville, TN – There’s no doubt about it. Filing for Social Security can be daunting.

On top of all that, there’s a ton of information – and misinformation – to weed through, as well as the need for some calculations based on several variables. Your benefits depend on your age, how long you’ve worked, what you earned, your marital status and number of dependents.

Seems like you have to factor in everything but your IQ. So to help, we offer some common misconceptions as well as some guidance on ways to get the most from your hard earned retirement benefits.

«Read the rest of this article»

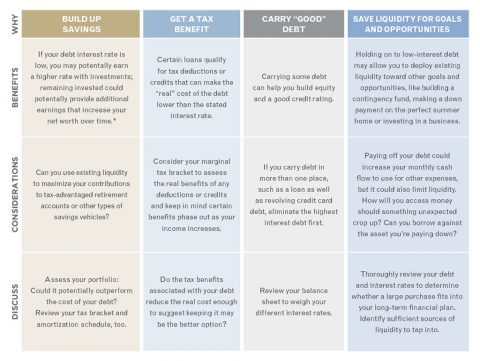

Frazier Allen: Can Debt be used to your advantage?

Clarksville, TN – “Debt” tends to call to mind a negative connotation. But, when used strategically, certain kinds can serve as useful financial tools, affording you access to more liquidity and potential growth down the road.

Clarksville, TN – “Debt” tends to call to mind a negative connotation. But, when used strategically, certain kinds can serve as useful financial tools, affording you access to more liquidity and potential growth down the road.

Before setting out to pay your debt off as quickly as possible, consider the various factors at play. You may find that the long-term advantages of holding certain types of debt can outweigh the benefits of paying it off sooner, so be sure to discuss the benefits and considerations with a knowledgeable financial professional.

«Read the rest of this article»

Clarksville Weekly Market Snapshot from Frazier Allen for the week of August 28th, 2016

Clarksville, TN – In her Jackson Hole speech, Fed Chair Janet Yellen was not expected to provide any significant clues about what will happen at the September 20-21 policy meeting.

Clarksville, TN – In her Jackson Hole speech, Fed Chair Janet Yellen was not expected to provide any significant clues about what will happen at the September 20-21 policy meeting.

Surprise! Yellen provided a strong hint that the central bank is a lot closer to raising short-term interest rates. Yellen said, “I believe the case for an increase in the federal funds rate has strengthened in recent months.” Take that in context with other evidence.

«Read the rest of this article»

Frazier Allen: Eight Estate Documents Everyone Needs

Clarksville, TN – Estate planning helps take the decision-making stress off you and your family. Having documents in place will allow you to define life’s big decisions, including how you would like your medical care and finances managed. Family members and healthcare providers will be clear of what you want if you are unable to speak for yourself.

Clarksville, TN – Estate planning helps take the decision-making stress off you and your family. Having documents in place will allow you to define life’s big decisions, including how you would like your medical care and finances managed. Family members and healthcare providers will be clear of what you want if you are unable to speak for yourself.

We can help you navigate the process and coordinate with an estate planning attorney to make sure your updated documents align with your financial plan.

«Read the rest of this article»

Frazier Allen: Are your estate and financial plans shock-proof?

Clarksville, TN – Retirement is a time to enjoy family, hobbies, travel, volunteering, and maybe even taking a job that sounds fun and keeps you active. You may be in great health today and can’t imagine a time when you wouldn’t be able to do all the things you’ve dreamed about.

Clarksville, TN – Retirement is a time to enjoy family, hobbies, travel, volunteering, and maybe even taking a job that sounds fun and keeps you active. You may be in great health today and can’t imagine a time when you wouldn’t be able to do all the things you’ve dreamed about.

While we all hope to live independently throughout retirement and plan to take care of ourselves, it’s still wise to put contingency plans into place, to shock-proof our financial and estate plans just in case.

«Read the rest of this article»

Frazier Allen: Declutter Your Retirement

Clarksville, TN – Leonardo da Vinci called simplicity the ultimate sophistication. Bruce Lee called it the key to brilliance. And Gandhi, who many believe was the definitive minimalist, said the secret of life lies in never missing material things.

Clarksville, TN – Leonardo da Vinci called simplicity the ultimate sophistication. Bruce Lee called it the key to brilliance. And Gandhi, who many believe was the definitive minimalist, said the secret of life lies in never missing material things.

What’s no secret is having less seems to be bringing more peace and happiness to those who have embraced this way of life. From small cars that counterpunched the SUV to tiny houses with their own television shows, it’s an increasingly popular choice.

«Read the rest of this article»

Clarksville Weekly Market Snapshot from Frazier Allen for the week of August 21st, 2016

Clarksville, TN – The FOMC minutes (from the July 26th-27th policy meeting) showed that officials were divided on the timing of the next rate hike. Some felt that the labor market had already tightened enough and that the Fed risked generating financial excesses by keeping rates so low for so long.

Clarksville, TN – The FOMC minutes (from the July 26th-27th policy meeting) showed that officials were divided on the timing of the next rate hike. Some felt that the labor market had already tightened enough and that the Fed risked generating financial excesses by keeping rates so low for so long.

Others felt that there was plenty of time to wait for more information and that it would be harder to correct course if the Fed moved too rapidly. Among voting FOMC members, the hawkish view (those wanting to raise rates sooner rather than later) appeared to be a minority.

«Read the rest of this article»

| « Older Articles | Newer Articles » |