Clarksville Area Chamber of Commerce August Events

Clarksville, TN – The Clarksville Area Chamber of Commerce announces upcoming events during the month of August.

Clarksville, TN – The Clarksville Area Chamber of Commerce announces upcoming events during the month of August.

On August 7th from 7:00am-9:00am, Uffleman Estates, 215 Uffleman Drive, will be hosting a Business Before Hours. Please join the Chamber for food and networking. [Read more]

First Advantage Bank promotes Michael Rye to Assistant Vice President of Commerical Business Banking

Clarksville, TN – First Advantage Bank has promoted Michael Rye to Assistant Vice President, Commercial Business Banking, strengthening the bank’s growing commercial lending team in Clarksville.

Clarksville, TN – First Advantage Bank has promoted Michael Rye to Assistant Vice President, Commercial Business Banking, strengthening the bank’s growing commercial lending team in Clarksville.

Weekly Market Snapshot from Frazier Allen for the week of July 30th, 2013

Market Commentary by Scott J. Brown, Ph.D., Chief Economist

The economic data reports were mixed. Existing home sales fell slightly in July. New home sales jumped 8.3% (although figures for the two previous months were revised lower and the July increase was not statistically different from zero). A measure of manufacturing activity in China weakened in July, but the same measure for the euro area was about flat.

The economic data reports were mixed. Existing home sales fell slightly in July. New home sales jumped 8.3% (although figures for the two previous months were revised lower and the July increase was not statistically different from zero). A measure of manufacturing activity in China weakened in July, but the same measure for the euro area was about flat.

Next week, no changes are expected from the Federal Open Market Committee, but investors will be sensitive to any changes in the wording of the policy statement. Future Fed policy decisions will be driven by the economic data (or more precisely, the implications that the data will have for the economic outlook). [Read more]

Clarksville’s Rainbow Inc. celebrates 10 years of Business

Clarksville, TN – On Friday, July 26th, Rainbow, Inc celebrated its ten (10) year anniversary in the Clarksville Industrial Park.

Clarksville, TN – On Friday, July 26th, Rainbow, Inc celebrated its ten (10) year anniversary in the Clarksville Industrial Park.

Rainbow Inc. was introduced in the Clarksville community in 2003 as an initiative of Iride, which operates in the Sassuolo region of Italy and has more than 28 years experience in cutting, grinding, polishing, and lapping ceramic tile.

Clarksville’s Belk Offering Free Mammograms August 9th-10th

Clarksville, TN – The BelkGives on the Go Mobile Mammography Center, a 39-foot-long, state-of-the-art screening center on wheels, will stop at Belk at the Governor’s Square August 9th-10th (Friday and Saturday) to offer free, convenient mammogram screenings.

Clarksville, TN – The BelkGives on the Go Mobile Mammography Center, a 39-foot-long, state-of-the-art screening center on wheels, will stop at Belk at the Governor’s Square August 9th-10th (Friday and Saturday) to offer free, convenient mammogram screenings.

Weekly Market Snapshot from Frazier Allen for the week of July 24th, 2013

Market Commentary by Scott J. Brown, Ph.D., Chief Economist

In his monetary policy testimony to Congress, Fed Chairman Bernanke said that “a highly accommodative monetary policy will remain appropriate for the foreseeable future.” He indicated that the Fed is using asset purchases “primarily to increase the near-term momentum of the economy, with the specific goal of achieving a substantial improvement in the outlook for the labor market.”

In his monetary policy testimony to Congress, Fed Chairman Bernanke said that “a highly accommodative monetary policy will remain appropriate for the foreseeable future.” He indicated that the Fed is using asset purchases “primarily to increase the near-term momentum of the economy, with the specific goal of achieving a substantial improvement in the outlook for the labor market.”

The Fed will rely on its forward guidance that short-term interest rates will continue to remain exceptionally low “to help maintain a high degree of monetary accommodation for an extended period after asset purchases end, even as the economic recovery strengthens and unemployment declines toward more normal levels.” [Read more]

Clarksville Transit System wraps Bus for Altra Federal Credit Union

Clarksville, TN – It’s advertising at its biggest and finest when the Clarksville Transit System wraps a bus. The newest addition to the fleet is the Altra Federal Credit Union bus wrapped in their brand colors of black and red.

Clarksville, TN – It’s advertising at its biggest and finest when the Clarksville Transit System wraps a bus. The newest addition to the fleet is the Altra Federal Credit Union bus wrapped in their brand colors of black and red.

The bus made it’s maiden voyage from the City bus terminal to the parking lot of Altra Federal Credit Union’s Madison Street location’s parking lot on Monday.

Legends Bank names Misty Kane as Branch Manager

Clarksville, TN – Legends Bank is pleased to announce the addition of Misty Kane as Branch Manager of its Clarksville office located at 1814 Tiny Town Road.

Clarksville, TN – Legends Bank is pleased to announce the addition of Misty Kane as Branch Manager of its Clarksville office located at 1814 Tiny Town Road.

As Branch Manager, Kane is responsible for the growth and profitability of the branch by retaining and building solid customer relationships with Clarksville area residents and businesses. She will also oversee daily operations and customer service.

Weekly Market Snapshot from Frazier Allen for the week of July 16th, 2013

Market Commentary by Scott J. Brown, Ph.D., Chief Economist

Fed Chairman Bernanke said nothing new, but the markets interpreted his comments as “dovish.” In Q&A following a speech on the history of the Fed, Bernanke said that given the high level of joblessness and low inflation, “you can only conclude that a highly accommodative monetary policy is needed.”

Fed Chairman Bernanke said nothing new, but the markets interpreted his comments as “dovish.” In Q&A following a speech on the history of the Fed, Bernanke said that given the high level of joblessness and low inflation, “you can only conclude that a highly accommodative monetary policy is needed.”

He also conceded that “there is some prospective gradual change in the mix of instruments, but that shouldn’t be confused with the overall thrust of policy, which is highly accommodative.” That’s consistent with the Fed beginning to lower the rate of asset purchases later this year and maintaining low short-term interest rates for a long time (well into 2015).

The June 18th-19th FOMC minutes showed that “many members indicated that further improvement in the outlook for the labor market would be required before it would be appropriate to slow the pace of asset purchases.” However, “several members judged that a reduction in asset purchases would likely soon be warranted.” [Read more]

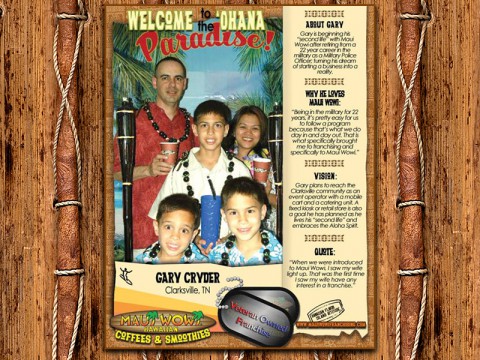

Fort Campbell retired military veteran opens Maui Wowi Hawaiian franchise in Clarksville

Greenwood Village, CO – The newest franchisee of Maui Wowi Hawaiian in Clarksville, Tennessee is beginning his “second life” after retiring from a 22 year career as a military police officer with the 501st Signal Battalion, 101st Airborne Division at Fort Campbell, KY.

Greenwood Village, CO – The newest franchisee of Maui Wowi Hawaiian in Clarksville, Tennessee is beginning his “second life” after retiring from a 22 year career as a military police officer with the 501st Signal Battalion, 101st Airborne Division at Fort Campbell, KY.

Transitioning from the structured Army lifestyle, Gary Cryder is going from one family to another as he begins his business and brings the Aloha lifestyle to his community.