Comedy on the Cumberland to benefit Restore Ministries of YMCA

April 19, 2012

Using Laughter to Change our Community

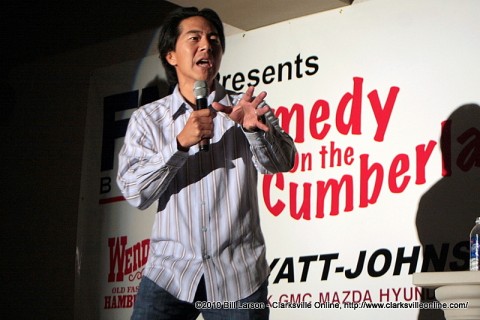

Clarksville, TN – The hilariously funny Comedy on the Cumberland returns for another season of stand-up comedy in Clarksville, April 24th, 7:00pm at the Riverview Inn, to benefit Restore Ministries and the YMCA.

Clarksville, TN – The hilariously funny Comedy on the Cumberland returns for another season of stand-up comedy in Clarksville, April 24th, 7:00pm at the Riverview Inn, to benefit Restore Ministries and the YMCA.

Restore Ministries is a new program that offers small groups, counseling and other services to help those in our community make lasting positive changes in their lives. No matter what needs attention and healing, Restore Ministries can provide the support and guidance a person needs to learn, grow and ultimately thrive. Restore Ministries accomplishes this two ways: counseling and small groups.

Road Closures announced for Rivers and Spires Festival

April 18, 2012

Clarksville, TN – Road closures for this week have been announced for the 10th Annual Rivers and Spires Festival in downtown Clarksville.

Clarksville, TN – Road closures for this week have been announced for the 10th Annual Rivers and Spires Festival in downtown Clarksville.

Also, starting the morning of April 19th, parking will be restricted in some downtown areas. There will be orange “No Parking” bags placed over meters in the restricted parking areas. [Read more]

Comedy on the Cumberland is coming April 24th

April 17, 2012

Clarksville, TN – Comedy on the Cumberland, presented by F&M Bank is Tuesday, April 24th at a new venue, the Riverview Inn starting at 7:00pm. The headliner for the show is Nate Bargatze and rising star Jonnie W. will be featured. This show will benefit the Restore Ministries of the YMCA. [Read more]

Clarksville, TN – Comedy on the Cumberland, presented by F&M Bank is Tuesday, April 24th at a new venue, the Riverview Inn starting at 7:00pm. The headliner for the show is Nate Bargatze and rising star Jonnie W. will be featured. This show will benefit the Restore Ministries of the YMCA. [Read more]

Comedy on the Cumberland at the Roxy Regional Theatre December 6th

April 9, 2012

Clarksville, TN – When Comedy on the Cumberland began in Clarksville two years ago, the man behind the event said it was just an idea to generate advertising revenue, and raise money for local charity. Now the event has become one of the most popular stops by comedians around the country.

Clarksville, TN – When Comedy on the Cumberland began in Clarksville two years ago, the man behind the event said it was just an idea to generate advertising revenue, and raise money for local charity. Now the event has become one of the most popular stops by comedians around the country.

The Comedians from the December 6th, 2011 Comedy on the Cumberland show pose with their framed posters of the event given to them by even organizer Hank Bonecutter. (From left to right) Headliner Keith Alberstadt, Hank Bonecutter, comedian Christy Edison and comedian Brian Kiley.

Keeping Track of Expiring and New Tax Provisions

March 18, 2012

Clarksville, TN – A number of significant federal income tax provisions expired at the end of 2011, a fact that might be easily overlooked with so much attention being focused on the “Bush tax cuts” that are still in effect, but scheduled to expire at the end of 2012. And new Medicare-related taxes, effective in 2013, have received surprisingly little coverage.

Clarksville, TN – A number of significant federal income tax provisions expired at the end of 2011, a fact that might be easily overlooked with so much attention being focused on the “Bush tax cuts” that are still in effect, but scheduled to expire at the end of 2012. And new Medicare-related taxes, effective in 2013, have received surprisingly little coverage.

Of course, new legislation could always extend some or all of these provisions, but here’s a quick summary of how things stand.

Already expired

- Alternative minimum tax (AMT)— A series of temporary legislative “patches” over the last several years has prevented a dramatic increase in the number of individuals subject to the AMT–essentially a parallel federal income tax system with its own rates and rules. The last such patch expired at the end of 2011. Unless new legislation is passed, your odds of being caught in the AMT net greatly increase in 2012, because AMT exemption amounts will be significantly lower, and you won’t be able to offset the AMT with most nonrefundable personal tax credits.

- Qualified charitable distributions— This popular provision allowing individuals age 70½ or older to make qualified charitable distributions of up to $100,000 from an IRA directly to a qualified charity expired at the end of 2011. These charitable distributions were excluded from income and counted toward satisfying any required minimum distributions that you would have had to take from your IRA for the year.

- Bonus depreciation and IRC Section 179 expense limits — If you’re a small business owner or self-employed individual, you were allowed a first-year depreciation deduction of 100% of the cost of qualifying property acquired and placed in service during 2011; this “bonus” depreciation drops to 50% for property acquired and placed in service during 2012, and disappears altogether in 2013. For 2011, the maximum amount that you could expense under IRC Section 179 was $500,000; in 2012, the maximum is $139,000; and in 2013, the maximum will be $25,000.

- State and local sales tax— If you itemize your deductions, 2011 was the last tax year for which you could elect to deduct state and local general sales tax in lieu of state and local income tax.

- Education deductions— The above-the-line deduction (maximum $4,000 deduction) for qualified higher education expenses and the above-the-line deduction for up to $250 of out-of-pocket classroom expenses paid by education professionals both expired at the end of 2011.

Expiring at the end of 2012

- Federal income tax rates— After December 31st, 2012, we’re scheduled to go from six federal tax brackets (10%, 15%, 25%, 28%, 33%, and 35%) to five (15%, 28%, 31%, 36%, and 39.6%).

- Long-term capital gains rate— Currently, long-term capital gain is generally taxed at a maximum rate of 15%. And, if you’re in the 10% or 15% marginal income tax bracket, a special 0% rate generally applies. Starting in 2013, however, the maximum rate on long-term capital gains will generally increase to 20%, with a 10% rate applying to those in the lowest (15%) tax bracket (though slightly lower rates might apply to qualifying property held for five or more years). And while the current lower long-term capital gain rates now apply to qualifying dividends, starting in 2013, dividends will be taxed at ordinary income tax rates.

- 2% payroll tax reduction— The recently extended 2% reduction in the Social Security portion of the Federal Insurance Contributions Act (FICA) payroll tax expires at the end of 2012.

- Itemized deductions and personal exemptions— Beginning in 2013, itemized deductions and personal and dependency exemptions will once again be phased out for individuals with high adjusted gross incomes (AGIs).

- Tax credits and deductions— The earned income tax credit, the child tax credit, and the American Opportunity (Hope) tax credit revert to old, lower limits and (less generous) rules of application. Also gone in 2013 is the ability to deduct interest on student loans after the first 60 months of repayment.

- Marriage penalty relief— Tax changes that were originally made to address a perceived “marriage penalty” expire at the end of 2012. If you’re married and file a joint return with your spouse, you’ll see the effect in the form of a reduced 2013 standard deduction amount, as well as in lower 2013 tax bracket thresholds in the tax rate tables (i.e., couples move into higher rate brackets at lower levels of income).

New taxes effective in 2013

Two new Medicare-related taxes created by the health-care reform legislation passed in 2010 take effect in 2013:

- Additional Medicare payroll tax— The hospital insurance (HI) portion of the payroll tax–commonly referred to as the Medicare portion–increases by 0.9% (from 1.45% to 2.35%) for those with wages exceeding $200,000 ($250,000 for married couples filing jointly, and $125,000 for married individuals filing separately). The rate for self-employed individuals increases from 2.9% to 3.8% on any self-employment income that exceeds the dollar thresholds above.

- Medicare contribution tax on unearned income— A new 3.8% Medicare contribution tax is imposed on the unearned income of high-income individuals. The tax generally applies to the net investment income of individuals with modified adjusted gross income that exceeds $200,000 ($250,000 for married couples filing jointly, and $125,000 for married individuals filing separately).

Customs House Museum continues the Celebration of Women’s History Month

March 10, 2012

Clarksville, TN – On March 17th, the Customs House Museum and Cultural Center will host “The Power of Women” an inspirational and informative event for women on women’s issues, including a brunch and performance. Guest speakers will include breast cancer survivor Teri Johnson.

Clarksville, TN – On March 17th, the Customs House Museum and Cultural Center will host “The Power of Women” an inspirational and informative event for women on women’s issues, including a brunch and performance. Guest speakers will include breast cancer survivor Teri Johnson.

Austin Peay State University Woodward Library Society sets spring event

March 7, 2012

Clarksville, TN – An alumnus of Austin Peay State University who has made his name prominent in the acting circle will be the highlight at a signature event for the APSU Woodward Library Society.

Clarksville, TN – An alumnus of Austin Peay State University who has made his name prominent in the acting circle will be the highlight at a signature event for the APSU Woodward Library Society.

David Alford (’89) – author, composer, actor, director and producer – will perform a few selections from his fact-based musical “Smoke: A Ballad of the Night Riders” at the society’s spring social on Tuesday, March 20 in the Franklin Room of the F&M Bank, located on Franklin Street in downtown Clarksville. He also will share details of his creative writing process.

First Thursday ArtWalk in Historic Downtown Clarksville March 1st

February 27, 2012

Clarksville, TN – The Historic Downtown Clarksville Association (DCA), is proud to announce the First Thursday ArtWalk for March, 2012.

Clarksville, TN – The Historic Downtown Clarksville Association (DCA), is proud to announce the First Thursday ArtWalk for March, 2012.

This months artwalk will be held on March 1st, 5:00pm until 8:00pm, and as always will be held in the shops and galleries on Public Square, Franklin Street, Strawberry Alley, Main Street and Second Street. Participating merchants include The Framemaker, Ingredients, Rogate’s Boutique, ARTifacts, Hodgepodge, and many more.

As always, this is a free event so bring your family and friends downtown to the Artwalk.

Comedy on the Cumberland recognized by Banking Magazine

February 25, 2012

Clarksville, TN – The Tennessee Banker magazine has recognized the community efforts of F&M Bank for it’s support of Clarksville’s popular “Comedy on the Cumberland” franchise. The stand-up comedy show that raises money for various local charities in Clarksville has been hugely successful in raising awareness of community charities, and generating much need cash for their operations.

Clarksville, TN – The Tennessee Banker magazine has recognized the community efforts of F&M Bank for it’s support of Clarksville’s popular “Comedy on the Cumberland” franchise. The stand-up comedy show that raises money for various local charities in Clarksville has been hugely successful in raising awareness of community charities, and generating much need cash for their operations.

Clarksville’s holds 5th Annual Downtown for the Holidays

December 5, 2011

Clarksville, TN – In what has become a Christmas Tradition, the City of Clarksville held their annual Downtown for the Holiday event on Saturday.

Clarksville, TN – In what has become a Christmas Tradition, the City of Clarksville held their annual Downtown for the Holiday event on Saturday.

The event kicked off with the Jingle Bell Jog 5K Road Race in the morning, followed that afternoon by Christmas Caroling on the steps of the Montgomery County Court House along with free hot chocolate for the kids. The evening closed out with the 5th Annual Lighted Christmas Parade.